Optimize Competitive Returns

In today’s fast-paced business landscape, understanding how to effectively optimize competitive returns has become a crucial skill for organizations striving to maintain a competitive edge and enhance profitability. Families of metrics and benchmarks play a vital role in this optimization process, assisting businesses in assessing their performance in relation to competitors. This article delves into the intricacies of optimizing competitive returns, presenting key strategies, insights, and real-world examples to guide companies in achieving sustainable growth.

Understanding Competitive Returns

Before delving deeply into optimization strategies, it is essential to define what competitive returns are. In business terms, competitive returns refer to the financial gains a company realizes relative to its peers in the market. These returns can be measured in various forms, including profit margins, return on investment (ROI), and market share growth. Understanding this concept is fundamental as it shapes the strategies and measures companies adopt to enhance their market position.

The Importance of Competitive Analysis

Competitive analysis is a cornerstone of optimizing returns. By examining competitors’ strengths and weaknesses, businesses can identify market gaps and opportunities. The strategic insights derived from competitive analysis not only inform product development but also marketing strategies, pricing models, and customer engagement tactics.

Key Metrics for Measuring Returns

- Return on Investment (ROI): A critical metric that assesses the profitability of investments relative to their costs.

- Market Share: Understanding a company’s share in the market helps gauge its competitive position.

- Customer Acquisition Cost (CAC): This metric aids in understanding the expense incurred while gaining a new customer.

Strategies for Optimizing Competitive Returns

With an understanding of competitive returns established, the focus shifts to actionable strategies for optimization. To improve competitive returns, businesses must consider a myriad of approaches, from leveraging data analytics to enhancing customer experience.

Leverage Data Analytics

Data analytics empowers organizations to make informed decisions based on empirical evidence rather than assumptions. By analyzing customer behaviors, market trends, and competitor performance, companies can pivot their strategies effectively. Incorporating tools such as predictive analytics can provide forecasts about future trends, significantly aiding in strategic planning.

Enhancing Customer Experience

Delivering exceptional customer experiences is synonymous with enhancing competitive returns. By employing techniques such as personalization, companies can build strong relationships with customers. This not only increases customer loyalty but also encourages repeat business, thereby significantly enhancing returns.

Implementing Effective Pricing Strategies

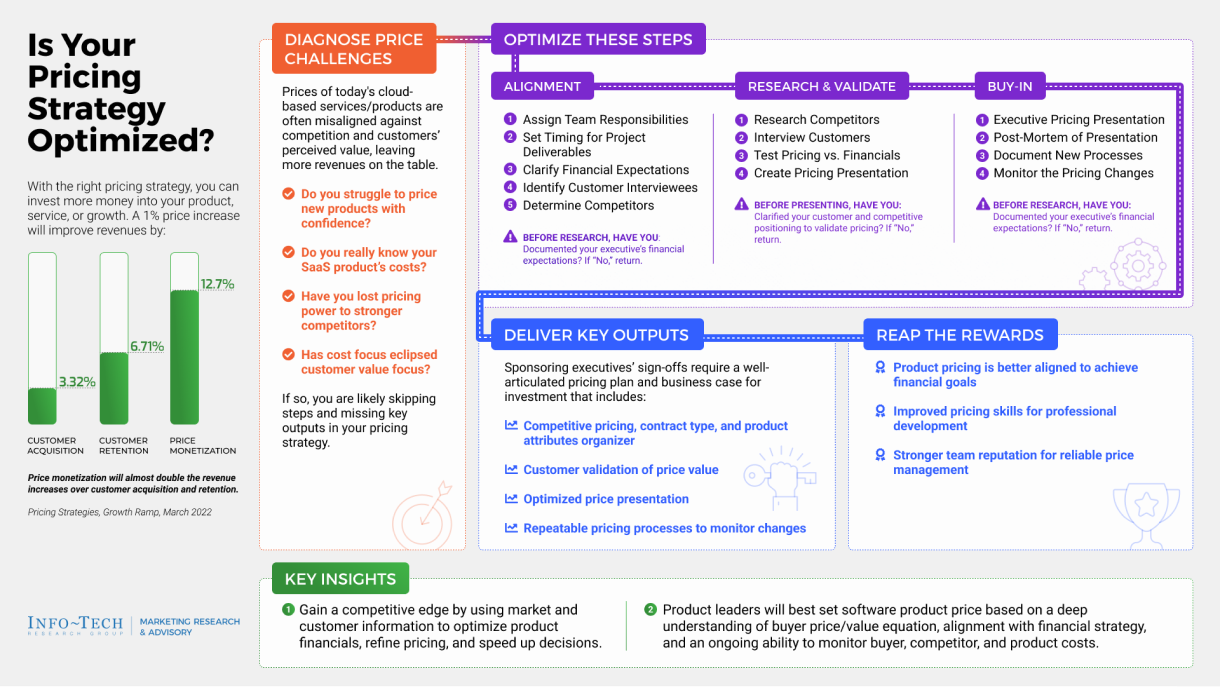

Pricing strategy directly impacts profitability. Companies must analyze competitor pricing and perceived value to optimize their own pricing models. This might involve experimenting with discounts, bundling products, or employing dynamic pricing strategies to maximize revenue.

Continuous Monitoring and Adaptation

In a continuously evolving market, businesses must remain agile. Implementing a structured plan for regularly reviewing and adapting strategies ensures companies can respond quickly to changes in the competitive landscape. This could involve scheduling quarterly reviews and employing performance metrics that align with business objectives.

Case Studies on Optimizing Competitive Returns

To further illuminate the effectiveness of these strategies, here are a couple of real-world examples illustrating companies successfully optimizing their returns.

Case Study 1: Tech Corporation A

Tech Corporation A implemented advanced data analytics tools to streamline their product development process. By analyzing customer feedback and market trends, they managed to launch a new line of products that surpassed sales projections by 30%. This not only boosted their market share but also significantly improved their ROI.

Case Study 2: Retailer B

Retailer B focused on enhancing customer experience through personalized marketing. By using customer data to tailor their marketing messages, Retailer B saw a 25% increase in customer retention rates and a notable decline in CAC. This strategic move increased their overall competitive returns effectively.

Conclusion

Optimizing competitive returns is a multifaceted endeavor that requires a nuanced understanding of both market dynamics and consumer behavior. With the right combination of data analytics, customer experience enhancement, and effective pricing strategies, companies can achieve significant improvements in their financial performance. As businesses continue to adapt to the rapidly changing landscape, staying informed and proactive will be essential in securing long-term success.

To learn more about competitive optimization strategies, visit this article for additional insights and frameworks that could enhance your understanding further.